The main objective of a physical or online business is to ensure that the customer's buying journey is as simple and appropriate as possible to their needs, so as not only to win their loyalty, but also for them to spend more on each purchase.

Payment security

In addition to the necessary investment in quality products and services, and the creation of a marketing and advertising strategy in line with the company's objectives, investment in payment security is undoubtedly one of the most important points for online and offline businesses to take into account.

PCI-DSS certificate

The PCI-DSS (Payment Card Industry Data Security Standards) certificate is an international security standard that guarantees that a company follows standards and good practices in its operations with debit and credit cards.

This security standard, developed and managed by an independent organisation made up of the main International Payment Systems (Visa Inc., MasterCard, Discover Financial Services, JCB International and American Express), was created in 2006.

In Portugal, REDUNIQ is the only PCI-DSS-certified acquirer, and its main objectives are:

- Maximising the protection of cardholder data and minimising the risk of data compromise.

- To protect cardholders in order to ensure the confidentiality and integrity of sensitive data associated with the use of payment cards, be it card data or authentication data.

- To protect companies from adverse financial and reputational consequences that could result from a breach of confidentiality.

PCI-DSS applies to physical payments (purchases at card payment terminals) and to online payments (e-commerce, websites and applications), defining the security standards that must be followed and regularly audited.

EMV 3-D Secure Security Protocol

In 2019, the European Union (EU) introduced the EMV 3-D Secure (or EMV 3DS) security protocol as the standard for the payments industry, given the exponential increase in online purchases and, consequently, in online payments during the pandemic.

Since then, the European authorities have decided to strengthen the security of this type of transaction with the new Strong Authentication Directive (PSD2) which, in short, obliges banks to ask customers for two or more security features when paying for online purchases by card.

Alongside this type of measure, businesses also have a say when it comes to secure payment methods over the Internet.

Online Business - how to receive payments securely on the internet?

Perhaps because it is still a new phenomenon for many consumers, the main focus of consumer concerns is the online payments.

According to a Visa studypublished in the first half of 2020, 46% of respondents were unsure about using credit/debit cards for online purchases.

Secure ways to receive online payments

In order to increase consumer confidence and reduce abandoned online shopping carts at the time of checkout (completion of the purchase with payment), REDUNIQ provides online businesses with two solutions that not only guarantee consumers secure online payment, but also help businesses to retain customers and increase sales.

The first of these is called REDUNIQ@Payments and, in practice, it's a turnkey solution created with businesses that sell online without a website in mind.

This solution allows you to accept online payments intuitively, simply, quickly and securely via a link sent by email, SMS, WhatsApp, Multibanco reference, MB WAY or Visa and Mastercard.

In practical terms, this solution will provide businesses with a platform, optimised for smartphones and tablets, where they can charge per payment link.

Once the customer has received this payment order by link, all they have to do is click to be redirected to a secure REDUNIQ page, thus ensuring that the digital retailer does not have access to the card details at any stage of the payment, making this operation completely secure for the customer and the business.

Alongside @Payments, REDUNIQ has developed the solution REDUNIQ E-Commerce which allows professional online shops with their own website accept online payments in Portugal with debit and credit cards, Visa and Mastercard, from customers all over the world with no membership or monthly fees.

And with all the security offered by the PCI-DSS certificate, which guarantees the privacy of sensitive customer data and prevents fraud.

Physical businesses - Contactless payments are safe

Despite being older and arousing fewer feelings of insecurity in customers, contactless payments were marginally used in the total number of payment methods used by consumers by the end of 2019.

If the EMV 3-D Secure security protocol has ensured greater consumer confidence in this type of payment using the contactlesshas done nothing more for democratisation of contactless transactions in physical shops, such as the promotional measures carried out by the Bank of Portugal and government authorities during the pandemic and the development of new payment terminals by REDUNIQ.

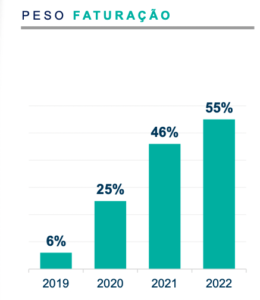

O contactless is safe and the statistics emphasise this. According to REDUNIQ Insightsno report for the first half of this year, the contactless payments in Portugal accounted for 55% of the total turnover of businesses connected to the REDUNIQ system, 9% more than in 2021 and 30% more than in 2020.

Contactless Billing Weight First Half 2022 | REDUNIQ Insights

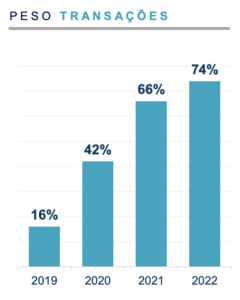

Underlying this growth is a change in the Portuguese consumer's habits, which is underlined by the rise in transactions using contactless means of payment, which at the end of June accounted for 74% of all transactions carried out in the period under review, 9% more than in 2021 and 22% more than in 2020.

Weight of Contactless Transactions First Half 2022 | REDUNIQ Insights

Just like in online paymentsREDUNIQ has a say in the security of contactless payments.

Through the development of automatic payment terminals such as REDUNIQ Easy or the TPA Android REDUNIQ SmartThese help the business not only to increase the average ticket and make more sales, but also to make transactions safer for the customer and for the business itself.

In addition, these payment terminals prevent consumers from carrying large amounts of physical cash with them, the business from having much less cash on hand, thus avoiding theft or mitigating its severity and preventing errors with change, since the transaction through a payment terminal can be carried out with the same amount of cash. TPA will be realised for the right amount and there will be no need to give change.