Sinais positivos na reabertura dos negócios

Enquanto Direção-Geral de Saúde e governantes analisam os números relativos aos primeiros dias de Estado de Calamidade para que seja tomada uma decisão em relação à abertura de mais negócios durante o mês de maio, a REDUNIQ acaba de revelar o seu relatório sobre as principais tendências ao nível das transações durante a primeira semana do plano de desconfinamento em Portugal e os primeiros números são animadores.

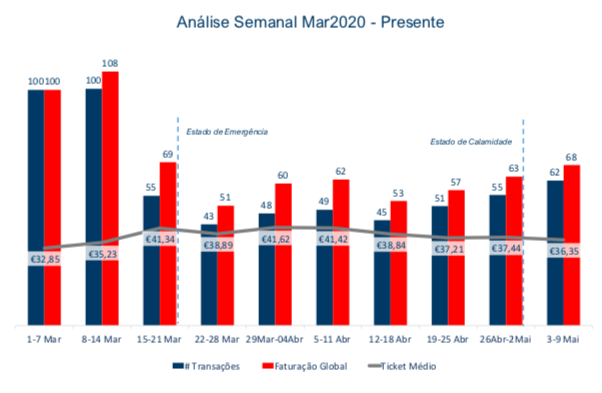

De acordo com o documento elaborado pela solução de conhecimento REDUNIQ Insights, entre 3 e 9 de maio (primeira semana de desconfinamento), o número de transações cresceu mais 11% do que na semana anterior para números a rondar os 6,2 milhões de euros, enquanto na última semana de Estado de Emergência os valores se tinham ficado pelos 5,6 milhões.

A par do valor da faturação, também o ticket médio (valor médio registado em cada transação) deu sinais de retoma. Com a abertura das lojas até 200m2 (sobretudo pequeno comércio) e mais portugueses na rua na primeira semana de desconfinamento, o ticket médio observou sinais de subida acentuada em vários setores de atividade. Neste domínio, a liderança cabe aos cabeleireiros com um ticket médio de 49,51€ na primeira semana de maio (em comparação com os 38,30€ da semana anterior), as papelarias, livrarias e tabacarias chegaram aos 42,37€ (29,89€ na última semana de abril), e as gasolineiras e os serviços do Estado mantiveram os seus tickets médios na ordem dos 24€. Ainda em relação às gasolineiras, no dia 30 de abril, antes do fim-de-semana prolongado de 1 maio, houve um aumento de 23% na sua faturação em comparação com o dia anterior.

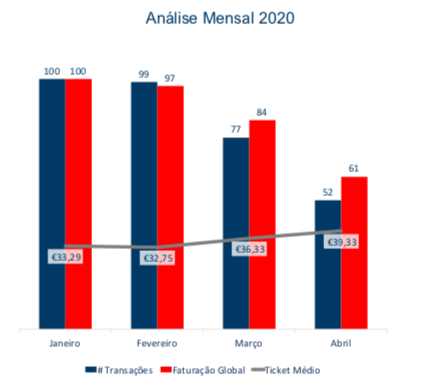

Após uma queda abrupta do número de transações totais na ordem dos 23,8% e dos 48,5% em março e abril face ao respetivos períodos homólogos, a economia começa agora a registar uma inversão desta evolução, com uma tendência crescente tanto no número de transações como no valor de faturação, dado que desde 4 de maio (primeiro dia da fase inicial de desconfinamento em Portugal), já mais de 10 mil negócios retomaram a sua atividades e voltaram a transacionar. Desta forma, estamos a conseguir, aos poucos, recuperar a nossa faturação, estando já a níveis de 70% em comparação com o período anterior à pandemia de COVID-19.

Se o ticket médio de cabeleireiros e papelarias foram os primeiros a beneficiar com o fim do Estado de Emergência, o valor médio das transações nos supermercados, hipermercados e no retalho alimentar tradicional atingiu o seu valor máximo na semana de 5 a 11 de abril (44,70€ e 27,72€, respetivamente), correspondendo a um crescimento de 61% e 50% face à primeira semana de março. Segundo o relatório REDUNIQ, e apesar dos dados se referirem ao período de confinamento obrigatório, tudo indica que que as pessoas foram menos vezes às compras, mas gastaram mais em cada ida.

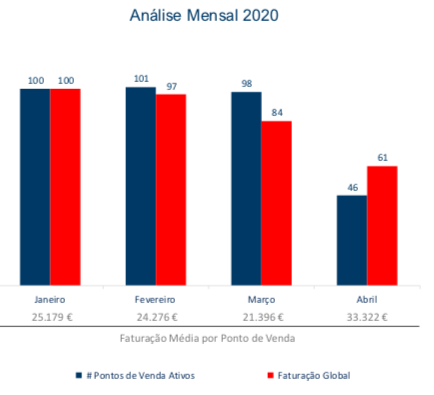

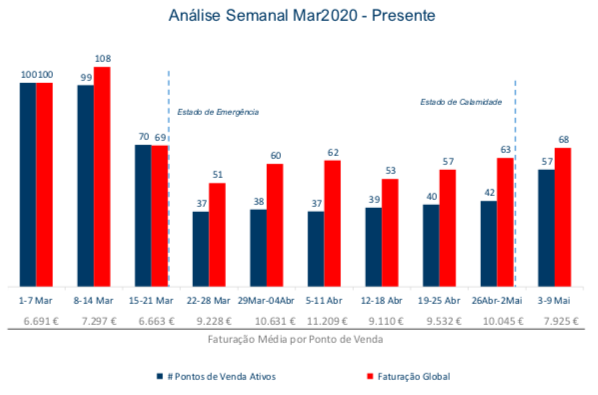

Igualmente importantes na análise destes números são os dados relativos aos pontos de venda ativos. Da semana de 8-14 de março para 22-28 de março assistiu-se a uma queda de 63% face ao número de pontos de venda a faturar no início de março. Os pontos de venda que continuaram a faturar assistiram a um aumento significativo da faturação média durante o Estado de Emergência, em média 150% acima dos valores pré-pandemia. Em algumas categorias, como por exemplo o retalho tradicional, esta crise, marcada por profundas assimetrias, representou uma melhoria de performance.

Com o fim do Estado de Emergência, a tendência parece estar a inverter-se registando-se, neste período, a reabertura de 10.000 pontos de venda o que significa um crescimento de 37% face à semana anterior.

Se as lojas físicas se viram obrigadas a fechar ou a trabalhar em horário reduzido, a necessidade obrigou os consumidores a virarem-se para o mercado online. Durante a primeira metade do período de análise, pós o decretar do 1º Estado de Emergência, as vendas em pontos físicos observaram, como já se enunciou, uma tendência de progressiva quebra.

Em contra-ciclo, para o mesmo período, as vendas no canal online evidenciaram uma importante aceleração com um aumento cerca de 20% face ao ponto de partida. Desde o decreto do primeiro Estado de Emergência no país, as vendas no canal online aumentaram de forma considerável, nomeadamente 162% em abril, face ao mesmo mês de 2019.

Comparando abril de 2020 com o período homólogo, as vendas online em lojas de retalho registaram um aumento de 241% na faturação, e um aumento de 25% no ticket médio (passando de 90,24€ para 112,73€).

Já em relação ao ticket médio, se compararmos abril com o período homólogo, regista-se um aumento de 30% (passando de 74,89€ para 96,67€).

Evolução da Faturação do Sistema por Canal (Loja Física vs. Online)

A necessidade de observarem o confinamento obrigatório que dirigiu o consumidor para o comércio online (e-commerce) aliado às indicações do Banco de Portugal para que os portugueses evitassem, sempre que possível, a utilização de dinheiro físico levou a um aumento histórico dos meios: online payments e contactless payments.

Daí não ser de estranhar que se tenha verificado que os pagamentos contactless tenham registado um aumento histórico durante a primeira semana de desconfinamento em Portugal, com mais 160% de transações através desta tecnologia face ao mesmo período de 2019. Após um mês de março com uma subida de 113% em relação ao período homólogo, e abril com mais 157% face ao mesmo mês de 2019, a utilização do contactless volta a subir na primeira semana de maio, uma tendência que se justifica pela abertura de mais de 10 mil estabelecimentos comerciais a 4 de maio. O mês de abril, face ao homólogo, demonstra ainda que os pagamentos contactless já tiveram um peso de praticamente 20% no total de toda a faturação.

Evolução da Faturação em Contactless (total Portugal)

Esta evolução é o reflexo de dois fenómenos que se têm manifestado junto dos comerciantes e dos próprios consumidores. Em primeiro lugar, os negócios reinventaram-se e passaram de negócios físicos a negócios online, existindo um crescimento de 333% do número de adesões a soluções de pagamentos online para parte dos comerciantes quando comparado o intervalo de tempo entre 13 de março e 25 de abril de 2019 e 2020; depois, porque os consumidores começaram a gastar mais em cada compra que efetuavam no online, tendo o ticket médio alcançado quase 105€ entre 13 de março e 25 de abril deste ano, enquanto que no mesmo período de 2019 esse valor estava nos 72,74€, menos 44%.

Como se percebe pelos números, a adaptação de negócios e consumidores a online payments e contactless payments tem sido rápida e assertiva, mais rápida ainda do que as estimativas feitas para este domínio antes da pandemia de Covid-19 previam.

Este relatório, que analisa informação detalhada sobre os diferentes perfis de consumo realizados em estabelecimentos servidos pela rede da REDUNIQ, para além de mostrar, para a primeira semana de desconfinamento, um crescimento exponencial da utilização da contactless technology para o pagamento em lojas físicas, evidencia que os comerciantes parceiros da REDUNIQ estão preparados para dizerem presente às alterações que a pandemia trouxe.

Para que um wearable (smartphone, pulseira, etc) ou um cartão contactless possa ser utilizado pelo consumidor, terá que existir, necessariamente, do lado do comerciante, um automatic payment terminal (physical or mobile POS) with contactless technology integrada para que o pagamento seja processado. Mais do que um terminal de pagamentos mais contemporâneo, os tpa contactless são, como os números provam, uma necessidade que os comerciantes têm que satisfazer de modo a, não só irem ao encontro das recomendações das autoridades de saúde pública e do Banco de Portugal, sobre a diminuição do risco de propagação com os “pagamentos sem contacto”, como também servirem convenientemente, alavancando com isso o seu negócio, o novo perfil de consumidor que emergiu do confinamento obrigatório.

To access the full report REDUNIQ Insights: Retalho | Antes, Durante e Depois do Confinamento 12 de maio 2020 please click HERE