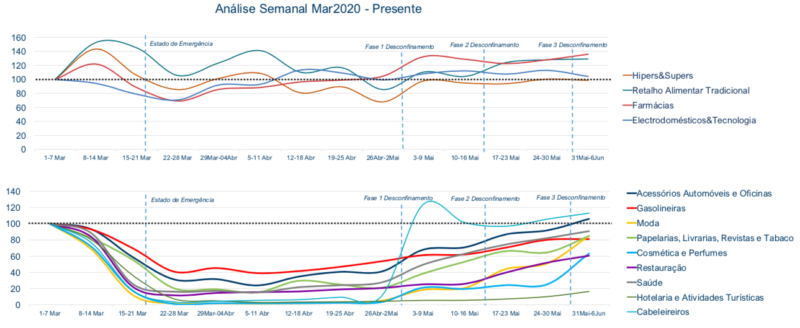

After a first month of deconfinement where the relevant notes were for the continued growth of the Contactless payments and for the recovery of various sectors of activity, including the Restoration which, in the first week of June, once again confirms the good momentum recorded in previous reports on the knowledge solution REDUNIQ Insights with this sector's turnover figures reaching 91% of the pre-pandemic figures.

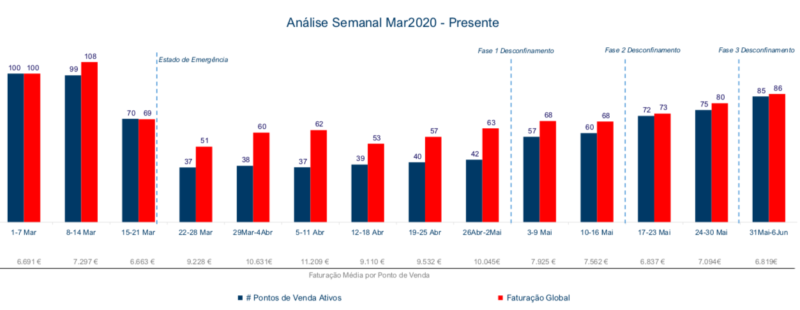

In addition to the growth in turnover, the report also emphasises that the Restoration already has 86% of its outlets invoicing, with a weekly average of €1,368 for each active point of sale. The average ticket (average value per purchase) in this sector is now 18.36€, close to the 18.99€ recorded in the first week of March.

Accompanying the positive spiral of RestorationIn the cosmetics and perfumes category, turnover rose by 150% at the beginning of June, thanks to the increase in the number of points of sale to be invoiced, which rose from 56% to 80% in one week.

Equally noteworthy is the fashion sector. In this analysis of the first week of June, this business area saw its points of sale increase by 24% compared to the previous week, while its turnover grew by 66%, and is now only 15% below the weekly total recorded in the pre-pandemic period. The average turnover per active point of sale grew by 34%, and is now higher than at the beginning of March.

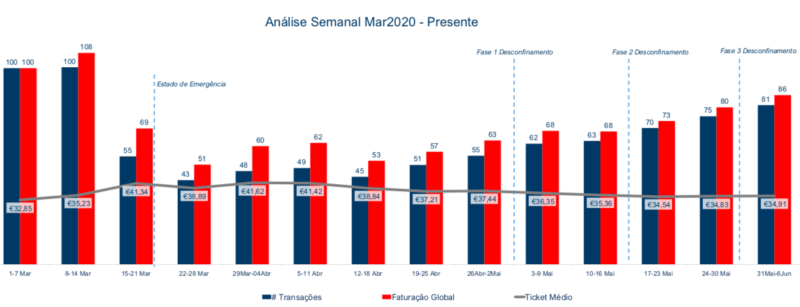

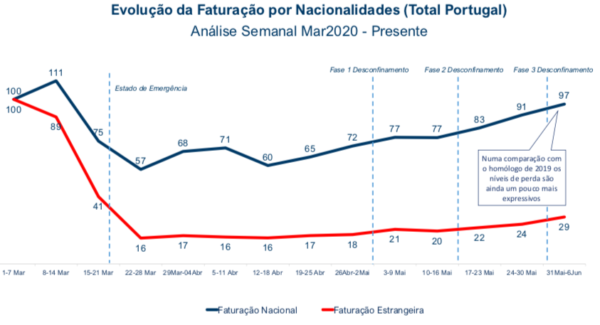

Leaving aside the sectoral analysis to look at total turnover in Portugal between 31 May and 6 June, it emerged that Portuguese businesses recorded more than 80% of the total achieved at the start of the pandemic in Portugal and 97% if we look at the pre-pandemic figures.

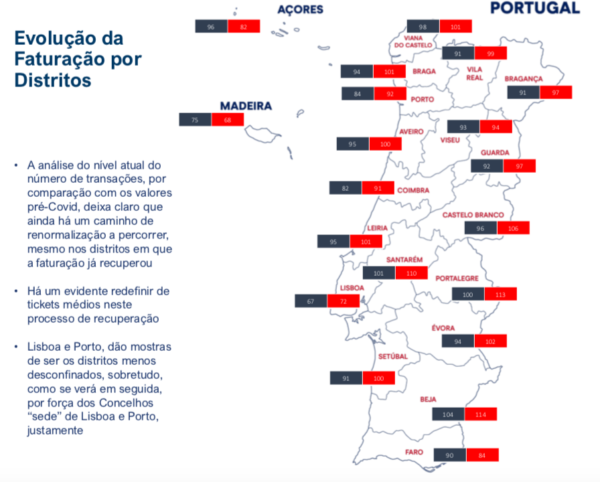

With regard to active points of sale, the report REDUNIQ Insights which analyses the evolution of transactions in Portugal from the first week of March to the period from 31 May to 6 June, the figures show a growth of 10% compared to the week from 24 to 30 May, rising from 75% to 85%, while invoicing from foreign cards stands at 29%.

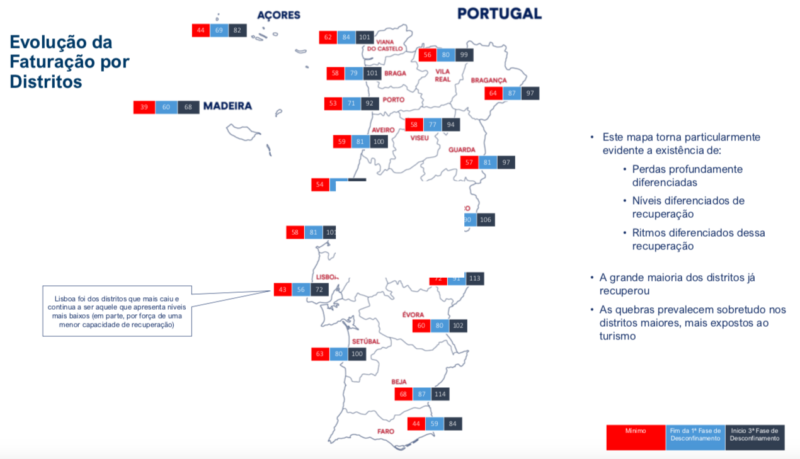

Narrowing down the scope and confining ourselves to a district-by-district analysis, we see that most Portuguese districts have already reached turnover levels close to pre-pandemic values, and some have exceeded this level. In this regard, the highlights are Beja, Portalegre and Santarém, which last week recorded 14%, 13% and 10% more, respectively, compared to the first week of March.

In the opposite direction are the Autonomous Regions of the Azores and Madeira, as well as the districts of Faro and Lisbon, which continue to have turnover levels below 90% compared to the figures seen at the beginning of March. Despite these figures, all the country's regions maintained their growth curve, both in terms of turnover and number of transactions.

Despite the downturn felt by tourism sector during the mandatory lockdown, with a special focus on the numbers of international tourists, the document drawn up by the REDUNIQ Insights show encouraging figures for foreign turnover. If we look at the districts of mainland Portugal with an airport (Lisbon, Porto and Faro), a phenomenon that is mainly due to the gradual recovery of some air routes, it should be noted that in the case of the capital, foreign invoicing rose by 18% compared to the previous week, although it still registered a quarter of the value observed in the pre-pandemic period.

The Faro region increased its foreign turnover by 23% from one week to the next (in comparison, its national turnover is already 18% above the levels recorded at the beginning of March). Finally, the district of Porto saw its foreign and domestic turnover grow by 29% and 15% respectively compared to the week of 24 to 30 May. With this rise, national turnover in the region exceeded pre-pandemic weekly levels for the first time.

It should also be noted that in the country as a whole, foreign invoicing grew by 18% between the week of 24 to 30 May and 31 May to 6 June.

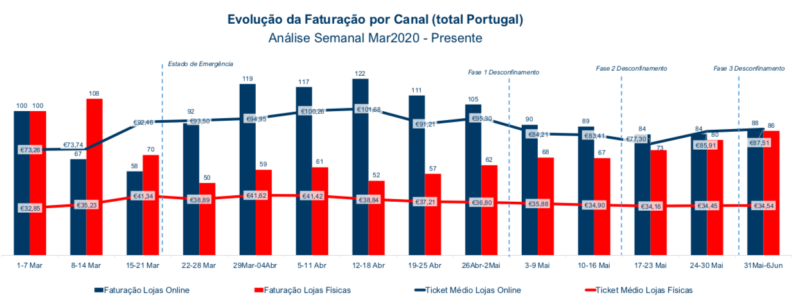

In great form during March and April, when record figures were registered (growth of 333% in the number of subscriptions to online payment solutions compared to the same period last year), turnover in the online channel experienced a slight lull in the first few weeks of the lockdown, only to return to growth at the beginning of June.

Last week, turnover in online shops is up 5% on the previous week, also increasing its average ticket to 87.51€, up 2% on the previous week.

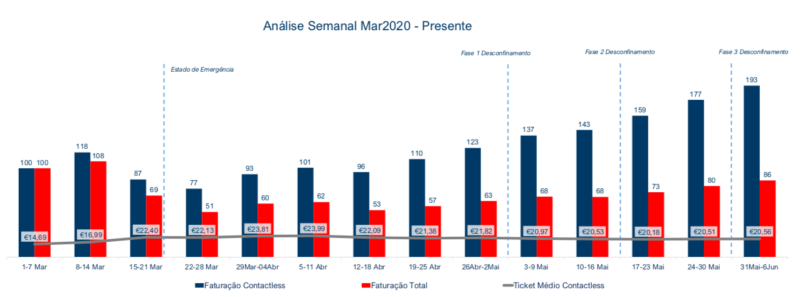

From growth to growth, this has been the conclusion after analysing the weekly data, since mid-March, on the Contactless payments. After a month of March with an increase of 113% compared to the same period of the previous year, and April with an increase of 157% compared to the same month of 2019, the utilisation of this contactless payment method accounted for 23.57% of the total turnover of Portuguese businesses (23.30% last week), and was 93% higher than the total recorded in the first week of March.

The growing penetration of Contacless accelerated with the deconfinement and the consequent return to the public space and the retail in physical shops, a trend that the report predicts will continue after the Bank of Portugal raised the possibility of maintaining the maximum limit of €50 for payments through the contactless technology.

In view of the growing need for businesses to adapt to the new forms of payment used by consumers, namely the contactless card, as evidenced by the figures, the REDUNIQ provides traders with a automatic payment terminal (physical or mobile POS) with contactless technology integrated so that the payment is processed securely and hygienically.

This Contactless TPAIn addition to enabling faster transactions and reduce the risk of spreading the virusAs the payment is made without the card (or wearables such as smartphones, etc.) and payment terminal touching each other, it also allows the merchant to reduce cash handling costs and guarantee that the payment is actually made.

To access the full report REDUNIQ Insights: Retail | Before, During and After Lockdown 09 June 2020 please click HERE

You can consult the other REDUNIQ Insights reports,