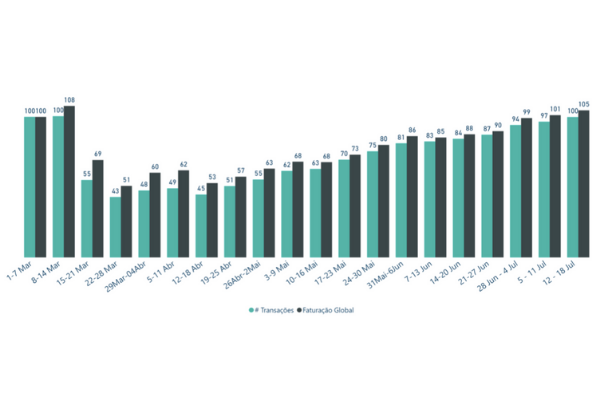

Although the overall turnover of Portuguese businesses has not yet reached pre-pandemic levels, the latest data revealed by the report drawn up by the knowledge solution REDUNIQ Insights show that in the first three weeks of July, the total value invoiced by businesses in Portugal surpassed the figures recorded in the first week of March.

While in the week of 5 to 11 July turnover was 1% higher than in the pre-Covid period, in the second and third weeks of July the total amount invoiced by businesses in Portugal was 5% higher than in the first days of March.

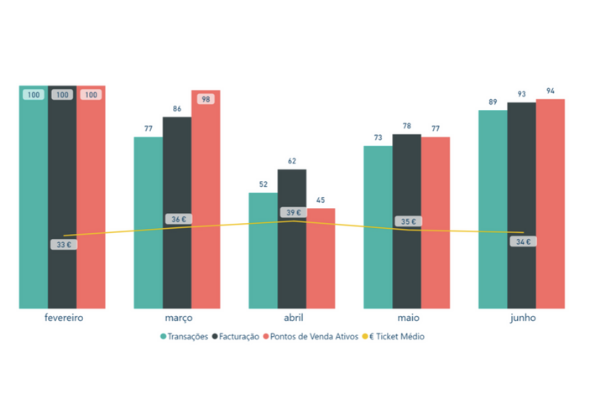

In the monthly analysis, which uses February as a basis for comparison (the last month before the pandemic), it can be seen that the month of June stood out for recording transaction values close to those recorded before the arrival of Covid-19 in Portugal. In terms of the number of transactions, last month reached 89% of the total recorded in February, while the total amount of invoicing was around 93% of the figures reached in the second month of the year. Similarly, the number of points of sale was also close to the pre-pandemic figures (94%).

According to the report, these figures show that a sustained rate of recovery is being maintained, corroborated by the weekly growth in absolute turnover figures compared to previous weeks.

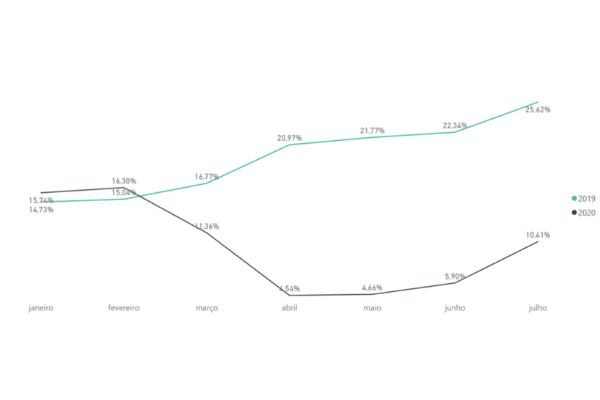

An important part of the country's economy, and in particular that of tourism sectorThe weight of foreign turnover has risen, but it is still a long way from what it would be in a normal year. In June, foreign invoicing accounted for 10.41% of this category in total business invoicing, despite its growth compared to the previous month and the boost provided by the reopening of borders, as opposed to the 25.62% recorded in the same period last year.

Despite this scenario, there was a recovery in foreign turnover between June and July, from 5.90% of total turnover to 10.41%.

In a more detailed sector-by-sector analysis, the report shows that from June to July there was a recovery in year-on-year growth in almost all the sectors analysed (with the exception of health), with six sectors achieving positive year-on-year growth this month, particularly pharmacies (56%), traditional food retail (35%), and household appliances and technology (25%).

This recovery is also visible in the evolution of the number of active points of sale by sector. In general, there has been a recovery in the opening of practically all points of sale, with reference to February's figures. The only sector to go against this trend is Hospitality and Tourist Activities, which is operating 20% below the figure seen in February, although it has been recovering since April, when it registered just 32% of active points of sale. In terms of accumulated losses since the start of the year up to 18 July (compared to the previous year), this sector has recorded losses of around 69%.

Although the losses are worrying, the Hospitality (in 2019 it accounted for 8.7% of national GDP) has been growing for four consecutive weeks, with the highlight being the week of the opening of borders, when turnover grew by around 40% compared to the previous week.

Beyond Hospitalityalso fashion, perfumeries and the Restoration are feeling the effects of the pandemic on their turnover, with accumulated losses up to 18 July and compared to 2019 of 46, 43 and 28%, respectively.

If areas such as hotel business have been facing difficulties, the online payment solutions e Contactlessin particular the latter, recorded historic growth and completely eclipsed last year's records.

If in relation to e-commerce paymentsaka online paymentsThe bulk of the growth took place during the period of compulsory confinement, when there was a 333% increase in the number of memberships to online payment solutions compared to the same period last year, the Contactless continues in an upward spiral.

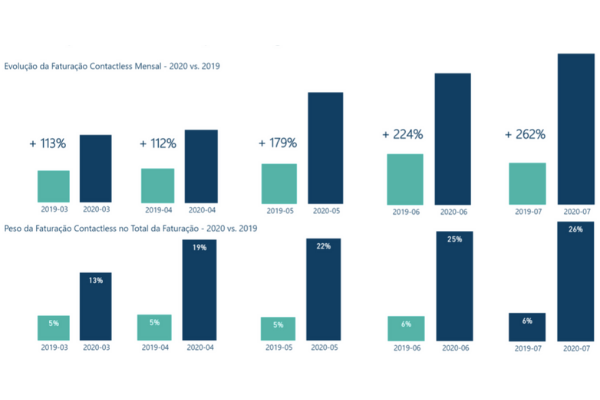

This month alone, the contactless payments grew by 262% compared to the same period last year. Currently, payments made through contactless technology have a weight of 26% in total turnover (24% in June), while in July 2019 this percentage was only 6%.

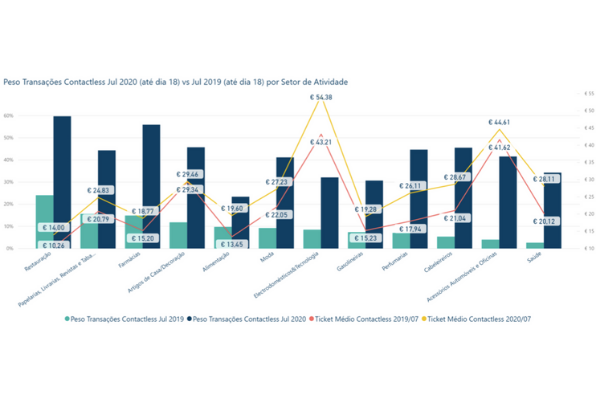

In terms of the weight of Contactless By sector of activity, it recorded average growth of around 30 percentage points in almost all categories. This is a technology that allows you to pay for a good/service by tapping a contactless card to a mobile phone. automatic payment terminal also contactless.

The "peloton" is led by Restoration with 60% (23% in 2019), followed by the Pharmacies sector with 56% (15% in 2019) and Hairdressers (6% in 2019) and Home/Decoration (11% in 2019) both with 46%. Sectors such as Health, Car Accessories and Workshops and Health recorded the biggest "jumps" compared to the previous year.

With regard to the average ticket (average value recorded in each transaction), the document leaves no room for doubt - a generalised increase in this value in all sectors of activity, especially in the area of Household Appliances & Technology, which went from 43.21 euros in 2019 to 54.38 euros in July 2020 (data up to the 18th).

The greater hygiene, speed and convenience of this type of payment do not fully explain this phenomenon. According to the data that has been compiled by REDUNIQThese indicate that the Contactless transactions are already an integral part of the daily lives of Portuguese consumers and businesses in what they define as "behaviour that has become democratised".

In line with this idea, the REDUNIQ provides traders with a automatic payment terminal (physical or mobile POS) with contactless technology integrated so that the payment is processed securely and hygienically.

This Contactless TPAIn addition to enabling faster transactions and reducing the risk of spreading the virus, since payment is made without a card (or wearables such as smartphones, etc.), and in order to reduce the risk of spreading the virus. payment terminal touch, it also allows the merchant a reduction in cash handling costs, higher average transactions and the guarantee that the payment actually goes through.

To access the full report REDUNIQ Insights: Retail | The Shape of the Ongoing Deconfinement [23 July 2020] please click HERE

You can consult the other reports at REDUNIQ Insights.