After two years of apathy, tourists are once again filling the streets of Portugal and businesses are thanking them. According to figures in the REDUNIQ Insights reportAccording to the report, on the evolution of card invoicing achieved by the businesses in Portugal during the first half of 2022, the businesses closed the first half of 2022 with an accumulated growth in invoicing from cards of 45%, compared to 2021.

Billing Evolution 2022 Vs. 2021

This huge increase is partly justified by the fact that the first quarter of 2021 was marked by a mandatory lockdown, suspended teaching activities and teleworking. Even so, the second quarter showed significant growth figures of 40% compared to the same period last year, thanks to the recovery in tourism activities.

Also worth mentioning is contactless payments, which grew by 87% in the first six months of this year, a topic we'll return to in more depth later.

As we've mentioned, the upturn in tourism was one of the pillars of this sharp growth in turnover. In this regard, the report indicates that in the first half of the year, foreign invoicing was already 25% higher than in 2019, which will have been one of the best years for tourism in Portugal (around 27 million tourists). Meanwhile, domestic card sales continued to rise compared to 2021, showing a normalisation of Portuguese consumer behaviour.

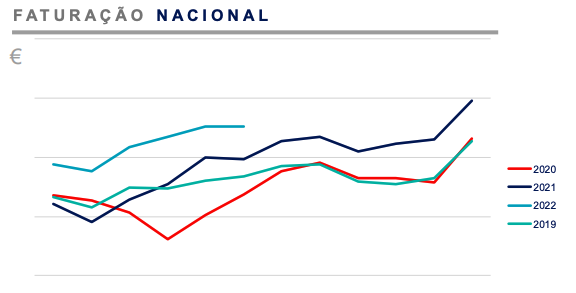

Invoicing Evolution by Origin - National Invoicing

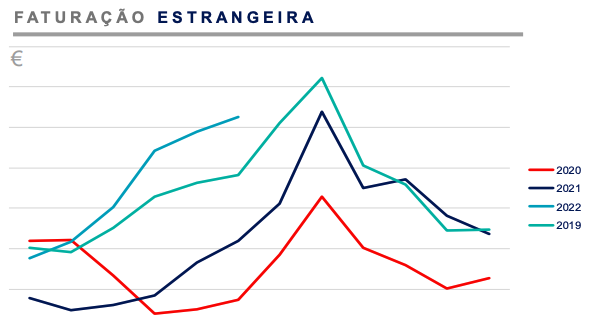

Changes in Invoicing by Origin - Foreign Invoicing

As the graphs show, the year 2022 marks a clear recovery in tourism, which during 2021 was still at levels well below those seen in 2019, pre-pandemic.

In the first half of the year, foreign turnover was already around 25% higher than in 2019, which will have been one of the best years for tourism in Portugal (around 27 million tourists).

The evolution of national turnover compared to 2021 shows a normalisation of the Portuguese consumption profile. After a strong start to the year in terms of consumption, there is a gradual slowdown in growth rates.

The growth rates seen in May and June were lower than 20%, less than half of the previous 4 months, showing what may be a loss of confidence among the Portuguese due to the war in Ukraine and the brutal rise in inflation.

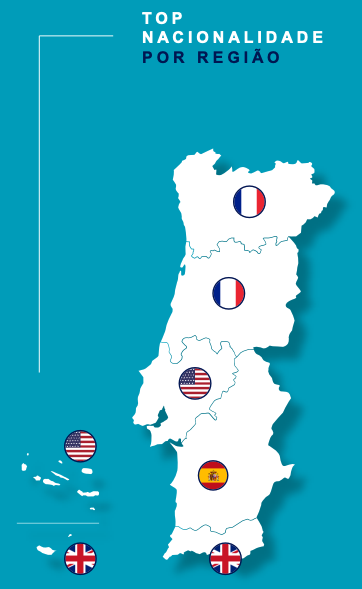

A curiosity: the boost in tourism came on the back of the return of tourists from countries such as the United States (weight of 11% in 2022 vs. 8% in 2019) and Ireland (9%) - which enters the top 5 nationalities, removing Spain from the list of countries with the greatest weight in consumption in Portugal. Despite a loss of 6%, a natural effect of BREXIT, the United Kingdom continues to be the most important source of tourists visiting Portugal (16% of the total).

Top Nationalities by Region

Consumers return in force to shopping centres

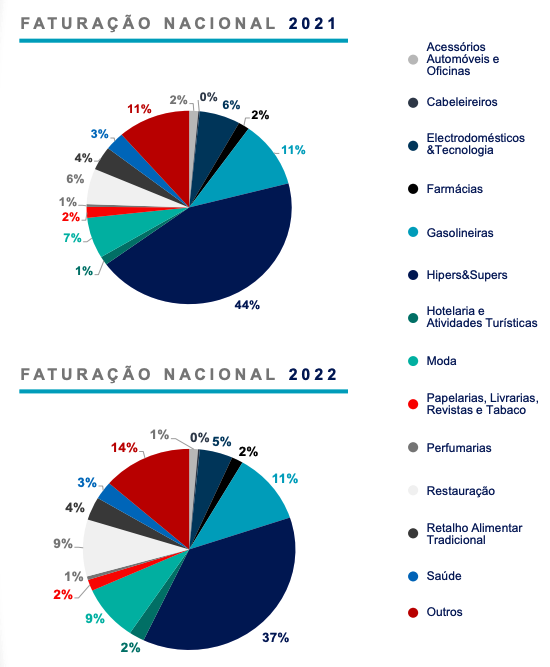

Consolidating the reality observed at the end of 2021, the figures for the first half of 2022 reinforce the return of consumers to shopping centres, which have already surpassed 2019 sales (even compared to 2021, there is a 2% increase in the weight of fashion, a category closely associated with shopping centre consumption), and the return to leisure (3% increase in the weight of restaurants).

A consequence of this normalisation of consumption is also the 7% drop in the weight of the Hyper&Super category, which has been a significant part of the Portuguese consumer basket during the pandemic.

National Invoicing by Sector 2022 and 2021

Inflation is also a reality that had an impact on the level of Portuguese consumption in the last six months. Proof of this is the increase in the average value per transaction, which started at 31€ in January and rose to 34€ in June.

National Average Purchase 2022 and 2021 (1st Half)

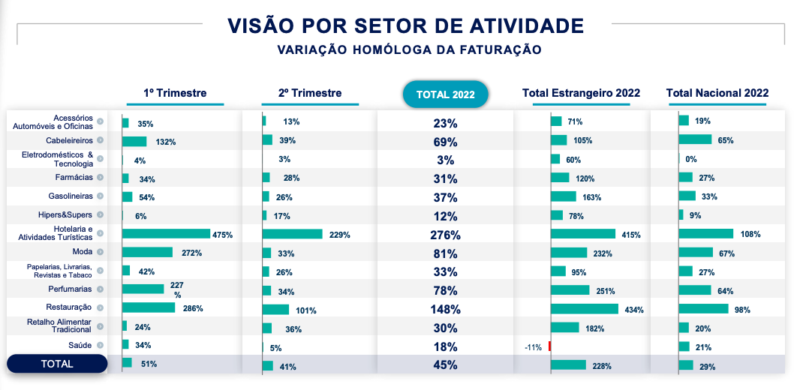

In a sectoral analysis, the categories that have proved most resilient throughout the pandemic, such as household appliances and technology (+3%), Hyper&Super (+12%), traditional food retail (+30%) and pharmacies (+31%) are now showing the most moderate growth compared to 2021. At the other end of the spectrum, the categories that in 2021 were most impacted by consumer behavioural restrictions and inhibitions are the ones showing the highest growth rates at the start of 2022: hotels and tourist activities (+276%) and restaurants (+148%), both of which saw growth of more than 400% in the case of foreign turnover.

Overview by Activity Sector - Year-on-Year Change in Turnover

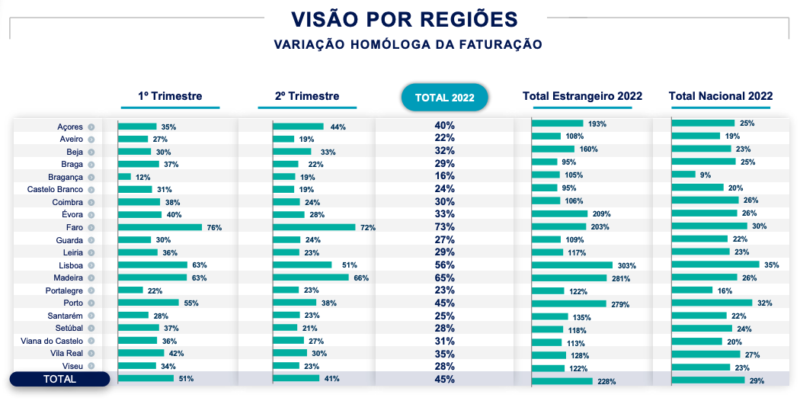

From the sectoral view, we move on to the geographical view, which shows a clear recovery in consumption, across the board, with an increase in all districts.

View by Region - Year-on-Year Change in Turnover

The districts where tourism is a basic economic activity, such as Madeira and Faro, stand out in particular as territories with the highest growth, with growth of more than 60% compared to 2021. The Lisbon and Oporto regions, which were also heavily impacted by the tourism downturn and where teleworking was most evident, were the ones that showed the most significant recovery in both Portuguese consumption (+30%) and foreign consumption (close to 300%).

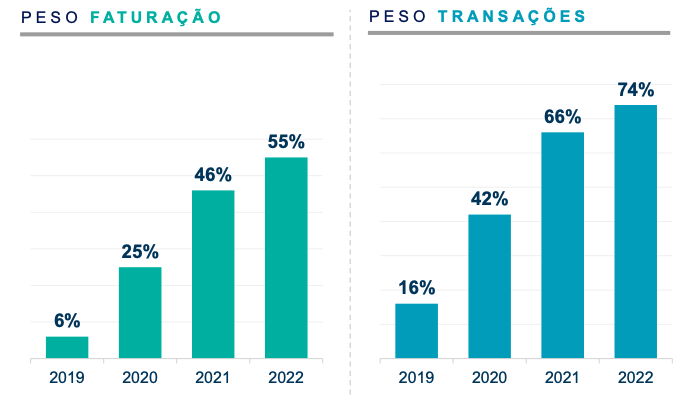

Contactless payments account for 55% of turnover

Also with regard to consumer habits, contactless as a payment method is becoming increasingly democratised among consumers. In the last six months, around 3 out of 4 card purchases (74%) were made using contactless technology.

Contactless - Billing Weight and Transaction Weight

This shows that contactless is already unquestionably part of the day-to-day life of practically all Portuguese people, and the expectation is that the use of this technology will continue to increase, albeit more slowly, in the Portuguese consumer's daily life, in line with the reality in other European countries.

The report also tells us that the weight of POS payments using contactless means already accounts for 55% of the total turnover of businesses connected to the REDUNIQ system, 9% more than in 2021 and 30% more than in 2020. As for transactions, the figures are even more impressive, with contactless accounting for 74% of the total, 9% more than in 2021 and 22% more than in 2020.